Sustainability Consultancy

Take control of your sustainability information for assessment and reporting.

Advisory services combining corporate sustainability, investment and regulatory expertise with leading technology solutions.

How We Can Help You

Data

A centralised library of corporate financial and sustainability reports to get you to the information quicker.

Research Tool

See disclosure evidence for yourself to make informed and independent decisions in line with best practice.

Benchmarking

Filter, search and compare a company’s sustainability disclosures on material issues in relation to its peer group.

Methodology

Our agnostic corporate sustainability framework developed by experts underpins the data to give you a head start on analysis.

Regulatory Experience

Our experience in international regulation means we understand its impacts today and to come, for investors and corporates alike. The flow of accurate and timely sustainability information is critical for compliance and we can help you anticipate and stay ahead of evolving regulation. Our data and tools can help you fulfil the latest sustainable fund classification requirements, surface risk and impact indicators directly from source, validate 3rd party data and fulfil data demands more efficiently and robustly.

Corporate Reporting

View a company’s disclosures through their investors’ eyes, compared to their competitors. We understand that research, analysis, assessment, engagement and due diligence are done through different lenses and will evolve over time. That’s why we provide granularity, transparency and flexibility so you can make the data work for your own purposes. Interrogate documents using the platform, run keyword searches, and export slices of data to incorporate into your own differential workflow.

Best Practice Sustainable Investment

We design regulatory compliant, best practice sustainability assessment models for our investment clients that combine our understanding of 3rd party ratings providers, alternative data, materiality frameworks and our technology expertise. Recognising data isn’t perfect and there will often be trade-offs, our solutions are designed with transparency and auditability, so that investment managers can explain their sustainability assessment principles and decision logic at every step, in line with best available information and technology.

Sustainability Standards & Materiality Expertise

Comparability, context and materiality are key to assessing corporate sustainability. Our experts have designed our technology tools to help you as the analyst to surface and then use decision-useful information. Our 15 NLP classifiers are trained on granular E, S and G issues to filter sentences by their relevance. Triage information quicker and export it into your own environment. We’ve done the arduous collation and categorisation so you can focus on what you do best.

>6000

Public & Private Companies

>140,000

Reports & ESG Documents

>116 million

Machine-Readable Sentences

Related Insights

27 June 2024

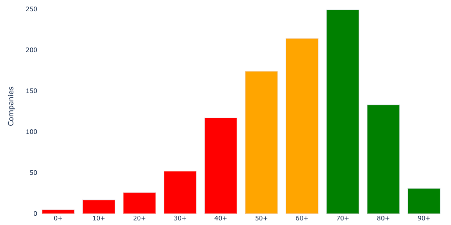

TDI Global reveals 59% of world’s largest companies are failing to meet basic reporting expectations, while the UK takes a clear lead

8 April 2024

Using AI to help financial regulators detect greenwashing. Presentation with ImpactScope at World AI Cannes Festival 2024

20 November 2023

Transparency & Disclosure Index reveals stark differences in reporting patterns across UK's largest companies

4 April 2023

Only 5% of FTSE100 have credible climate transitions plans according to EY: Insig AI's response

20 January 2023

Building a best practice ESG risk scoring system for private entities

7 October 2022